Peek of the Week - Weekly Market Commentary for March 4, 2024.

Read MorePeek of the Week - Weekly Market Commentary for February 26, 2024.

Read MorePeek of the Week - Weekly Market Commentary for February 20, 2024.

Read MorePeek of the Week - Weekly Market Commentary for February 12, 2024.

Read MorePeek of the Week - Weekly Market Commentary for February 5, 2024. Last week, the January 2024 Challenger Report found that employers based in the United States cut more than 82,000 jobs in January. That’s a lot. In December 2023, about 35,000 layoffs were announced. The January job cuts were concentrated in a few industries, and the reasons for the cuts included companies restructuring to lower costs and reorienting toward artificial intelligence.

Read MorePeek of the Week - Weekly Market Commentary for January 29, 2024. The United States economy is not performing the way anyone thought it would. Instead of tipping into a recession last year, it crushed expectations. Our Peek of the Week discusses the US Economy, inflation, Health Savings Accounts and investments.

Read MorePeek of the Week - Weekly Market Commentary for January 22, 2024. Our Peek of the Week could help answer that question for you. Consumers are a force to be reckoned with and that's because each and every one of us is a consumer, vital to the American economy. As we buy things like coats, tweezers, bread, electricity and even when downloading apps to use, we are consuming. It's reassuring to know that consumers are feeling more optimistic than they have in awhile. The University of Michigan Consumer Sentiment Index reported a double-digit rise in December 2023, and saw an additional 13 percent increase for Consumer Sentiment in January 2024. Last week, a rally in technology stocks helped the S&P 500 Index close at an all-time high. Wow!

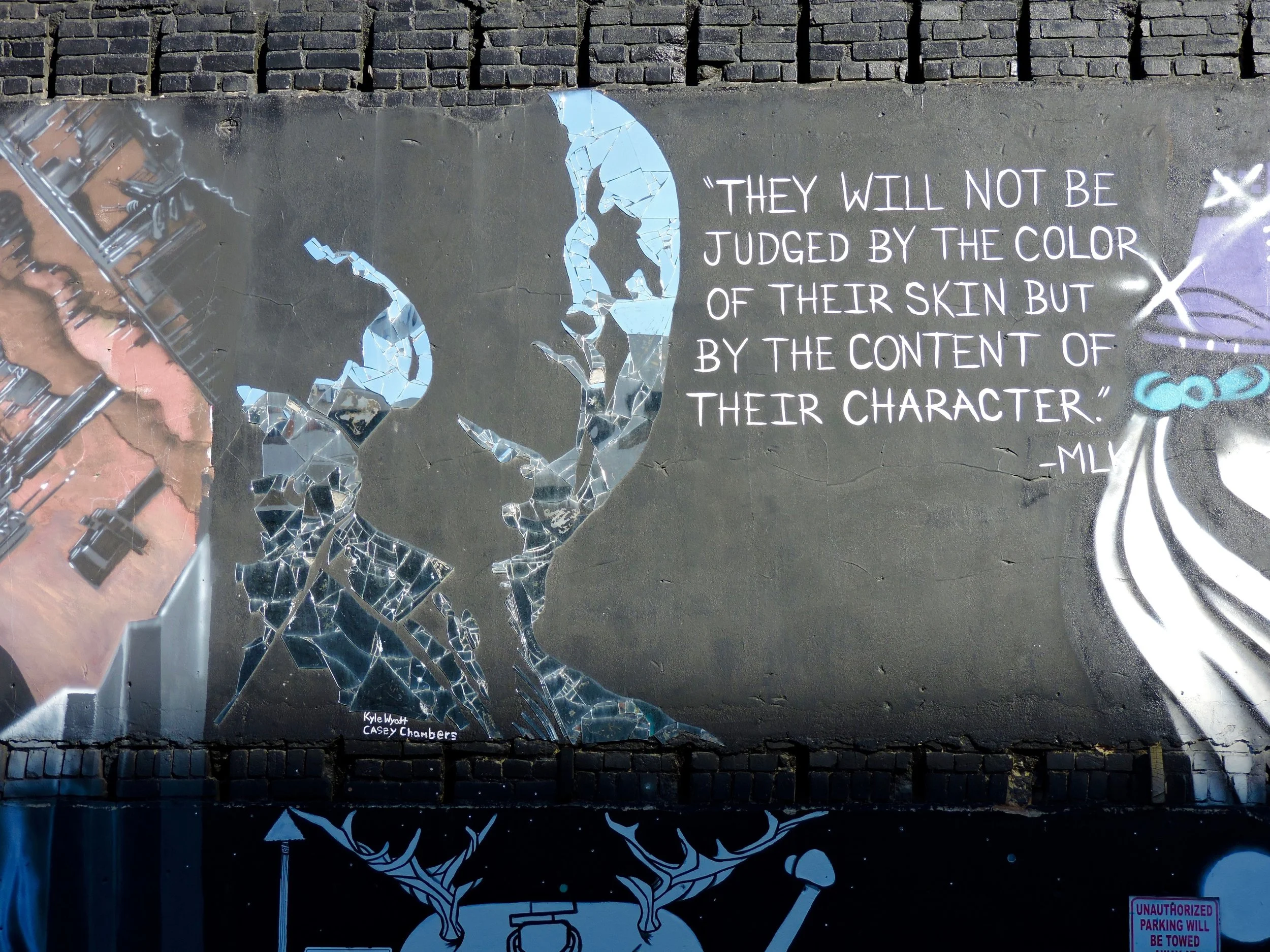

Read MorePeek of the Week - Weekly Market Commentary for Martin Luther King Jr. Day, January 15, 2024.

Read MorePeek of the Week - Weekly Market Commentary for January 8, 2024. Today's Peek of the Week explains the culprit to be "too much optimism" from investors. We learn there's a possibility for three rate cuts in 2024 and assuming the Fed drops rates by 0.25 percentage points each time, the federal funds rate could drop to 4.5 percent by the end of the year. If it happens, lower rates make borrowing less expensive for businesses and consumers, and it could boost corporate profits and push stock prices higher. Investors' offered their buoyant outlooks and took things a little too far, as the U.S. stock market retreated for much of last week.

Read MorePeek of the Week - Weekly Market Commentary for January 2. 2024. Today's Peek of the Week recaps the U.S. stock performance for 2023, explaining how the roots for the year were established back in 2022. Going back to 2022, economists were forecasting a 70 percent chance of recession for 2023 and that pessimism persisted for a lot of our year. Behavioral economics discovered that the pain of losing is far more powerful than the pleasure of winning. The year saw fluctuations in consumer sentiment as expectations for inflation and interest rates were all over the place. Our Peek of the Week explains the year's stock market ride and where we're currently at in the journey.

Read MorePeek of the Week - Weekly Market Commentary for December 18, 2023. Today's Peek of the Week shares an answer from Jerome Powell on the topic, considering his comments added to positive inflation news from earlier in the week. But the inflation picture isn't as rosy when you consider the numbers. Both headline inflation and core inflation ticked higher month-to-month, with core inflation being 4.0 percent over the previous year. Key contributors to the annual core inflation numbers are things like shelter costs, insurance, personal care and recreation. Global stock and bond markets celebrated falling inflation.

Read MorePeek of the Week - Weekly Market Commentary for December 11, 2023. Today's Peek of the Week shares recent stock market insights plus the idea that Federal Reserve will soon change course. Last week we saw employers adding more jobs than expected, the unemployment rate fell to 3.7 percent, and an employment report showed that average hourly earnings increased in November, rising 4 percent year-over-year. Inflation has softened but consumers are still feeling the pinch of prices. The S&P 500 gained for the sixth consecutive week, according to Bloomberg.

Read More